The Best Strategy To Use For What Is Trade Credit Insurance

The 30-Second Trick For What Is Trade Credit Insurance

Table of ContentsThe Basic Principles Of What Is Trade Credit Insurance The Basic Principles Of What Is Trade Credit Insurance What Is Trade Credit Insurance Can Be Fun For Anyone

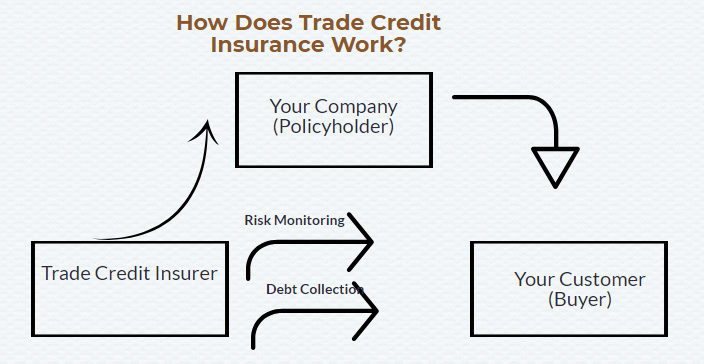

Throughout the year, if any of those purchasers go breast or don't pay, after that we will certainly make the repayment. We take a look at the entire turnover of a business and also we finance the entirety. "What we're translucenting electronic platforms is that people can browse the web and also can market a solitary billing.

The platforms can see the invoices that are superior and also can make a deal to acquire those exceptional billings. What the consumer can then do is take the selection to guarantee that solitary invoice. As soon as that billing is insured, it's essentially an assurance that the billing will be paid - What is trade credit insurance. "At Euler Hermes, our team believe there's going to be a shift in the method trade credit score insurance is dispersed.

Indicators on What Is Trade Credit Insurance You Need To Know

Required a broker? See our overview to finding the right broker.

A producer with a margin of 4% that experiences a non-payment of 50,000 would need 25 equal sales to make up for a solitary instance of non-payment. Credit report insurance coverage alleviates versus this loss. You can cut investing on credit history details as that's covered, and you will not require to squander resources on going after collections.

You might have the ability to negotiate beneficial terms with your vendors as a credit history insurance plan reduces the impact of an uncollectable loan on them and also possibly the entire supply chain. Credit report insurance coverage is there to Go Here help you prevent and also alleviate your trading dangers, so you can develop your organization with the expertise that your accounts are secured.

An organization desired to broaden sales with its present clients but was not entirely comfy using them greater credit line. They contacted Coface credit history insurance coverage to cover the higher credit line so they could raise the amount of credit history offered to clients without risk - What is trade credit insurance. This allowed them expand incomes and also provide this content more earnings.

The smart Trick of What Is Trade Credit Insurance That Nobody is Talking About

"From the initial purpose of offering convenience to our financial institutions, the service added depth to our service choices." The communication permitted the company to evaluate its customers' problem more accurately as well as see post has been an useful device in organization development.

Australian companies owe around $950 billion to various other services. Which implies it's vital to have defenses in place so that in case a financial institution does not fulfill its commitments, business can still redeem its cash. Taking out trade credit score insurance coverage is one method you can do this. Trade debt insurance provides cover when a consumer either ends up being insolvent or does not pay its financial obligations after a specific period (which is established out in the insurance coverage).

"In case a debt is unsettled, the plan holder might have the ability to assert approximately 90 per cent of the amount of that financial obligation, taking into consideration any type of unwanteds that may matter," he adds. When it involves accumulating the financial debt, frequently the insurance firm will have its very own financial obligation collection company and will certainly go after the debt on part of business.